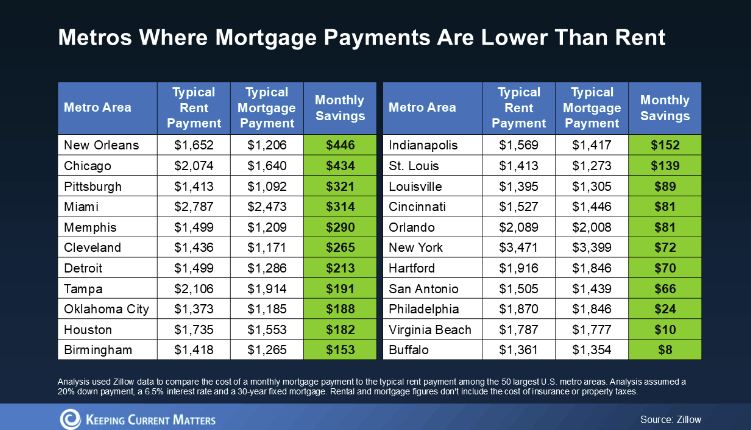

Buying May Beat Renting in 22 Major U.S. Cities

According to a recent study by Zillow, in 22 of the 50 largest metro areas, it’s now more affordable to buy a home than rent. This shift is due to lower mortgage rates, stable home prices, and rising inventory, making homeownership more attainable in many cities. Even if your city isn’t on this list yet, it may join soon as the market continues to adjust.

Why Buying May Be Better Than Renting

Although buying comes with additional costs such as property taxes, insurance, and maintenance, renters also face added expenses like renters' insurance, utilities, parking fees, and more. Plus, homeownership offers a major financial advantage—building equity. When you buy a home, your payments contribute toward ownership, and you can benefit from home price appreciation over time. Renters, on the other hand, miss out on this wealth-building opportunity.

Consider Your Long-Term Financial Goals

As Orphe Divounguy, Senior Economist at Zillow, points out, homeownership not only may lower your monthly costs but also allows you to build long-term wealth through home equity. This makes it a prime time to reassess your financial situation and determine whether buying a home is the right move for you.

If you’re wondering whether you can afford to buy now, consider connecting with a local real estate agent. They can help you calculate current costs and explore whether buying makes sense given today’s market conditions.

Bottom Line

With mortgage rates easing and home prices stabilizing, now is an ideal time to explore whether buying a home could save you money and help you build wealth. Reach out to a real estate agent to understand how affordability in your area has shifted and whether it’s time to transition from renting to owning.

Categories

Recent Posts

GET MORE INFORMATION

REALTOR® | Lic# S.0184988