Is Wall Street Really Buying All the Homes?

Let’s face it – buying a home right now can feel like an uphill battle. Between scrolling through endless listings, competing at open houses, and losing out to higher offers, it’s easy to wonder if there’s something bigger at play. You might’ve heard a common theory: Wall Street investors are buying up all the homes, leaving little for everyday buyers.

But is that true? Not really. While investors play a role, they’re not dominating the market as much as you might think. Here’s a breakdown of the facts to help you separate myth from reality.

Investors Make Up a Small Portion of the Market

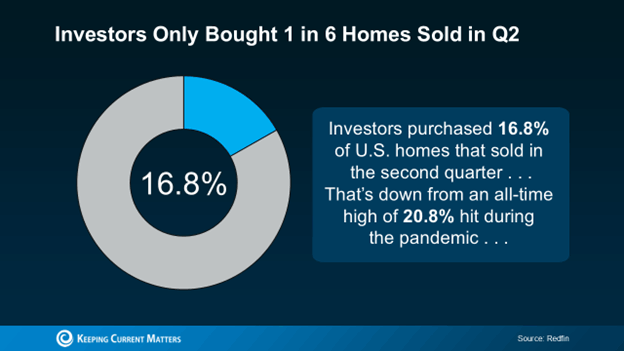

According to Redfin, institutional investors (like Wall Street firms) account for a relatively small fraction of home purchases:

Graph: Share of Home Purchases by Investors vs. Everyday Buyers

This means five out of every six homes are being purchased by individuals like you, not by big investors. The majority of homebuyers are still everyday people looking for a place to live, not massive corporations buying up properties.

Most Investors Are Small “Mom-and-Pop” Owners

When you hear "investor," you might picture a massive Wall Street firm buying thousands of properties. But the reality is much different. According to CoreLogic, most investors are small-scale individuals who own fewer than 10 properties. These might include:

- A neighbor renting out a second home.

- Someone with a vacation property.

- Local landlords with a handful of rental units.

In fact, large institutional investors (those owning thousands of homes) account for only about 1% of the market. So, while investors exist, the overwhelming majority are small-scale, everyday individuals.

Investor Purchases Are Declining

Not only are most investors small, but overall investor activity has been dropping. According to CoreLogic’s Investor Report:

“Investors made 80,000 purchases in June 2024, compared with 112,000 in June 2023, and a nearly 50% drop from the high of 149,000 purchases in June 2021.”

This sharp decline in investor purchases shows that competition from investors is easing. Projections indicate this downward trend will continue into 2025, giving everyday buyers more breathing room.

Key Takeaways

If you’re feeling discouraged in today’s housing market, it’s important to know the facts:

- Institutional investors aren’t dominating the market. Most homes are purchased by everyday buyers.

- Small-scale investors make up the majority of investor purchases. Wall Street’s share is minimal.

- Investor activity is on the decline. Competition from investors is waning, giving buyers a better chance.

Bottom Line

The idea that Wall Street is buying up all the homes is largely a myth. Most investors are small “mom-and-pop” landlords, and overall investor activity is slowing. That means you don’t need to worry as much about competing with investors as you navigate the market.

If you’re ready to explore homebuying opportunities or want a better understanding of the current housing market, connect with a local real estate agent today. They’ll provide you with the latest insights and guide you through the process with confidence.

Categories

Recent Posts

GET MORE INFORMATION

REALTOR® | Lic# S.0184988